I mention the Real Inflation is the Infaltion that is happening to you, not the 'number' released by your goverment in an old post titled "Inflation vs BLR". Below describe a quick summary how and what to do ...

1. List down all your "daily routine" items and their costs2. Determine what quantity / amount of each item is consumpt over a fix period of time3. Sum up the total cost for that periodThen compare the difference between 2 periods give you a rate, that is the Your Inflation !

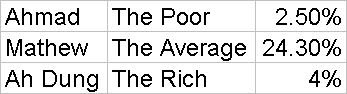

Lets get an update of this inflation rate from 3 real life examples. Each example represend one of the Rich, Average and Poor categories.

Ahmad used to spend RM 5 to fill his stomach in a day (Jan 2008), today he is still using about the same averaging at RM 5.10. By now, the garden he has been having has grown enough so that they can feed themselves more meals. He also found a few more places where he packed left over food for his family before he goes home every night. Hearing so many negative economy news, he didn't spend any extra money in clothing. The place he is squading remains the same, no extra cost. Bus fares increase quite a lot but he took some alternative routes and walk further to reach office, home and the stations. Calculating all of this month's living expenses shows that Ahmad's inflation rate is 2.5% this year. He doesn't think his life style has been degraded. As a matter of fact, he found an opportunity to sell some used goods in a flea market on the new route when he walk further to work.

Mathew : no where to go, so just keep looking ...

Mathew is self employ but forecast to lose about 20-30% of his business income this year. His wife stopped working since mid last year because her company was closed down. Mat used to pay RM 3.50 to RM 3.80 for a bowl of his favourite Pork Meat Noodle Soup, now he pays RM 3.80 to RM 4.50. His favourite drink Teh-C was RM 1.00 but now RM 1.10. So instead of ordering one small cup of Teh-C, he ordered a big one for RM 1.60 and shared with his wife. Prices of veggies and pork meat in wet market are not stable, he tried his best to buy whatever is cheaper at the time but still ended up an average cost increase about 5% to 15%. In hypermarket like Carrefour and Jusco, tuna flake can food went from RM 3.30 to RM 4.50; cheapest hot dogs from RM 2.90 to RM 3.80; salted pickle from RM 1.10 to RM 1.30 ... Mathew's inflation is 24.3%

Ah Dung : What ? What Crisis ?

Ah Dung continues to dine out in TGIF, Chillis, Coffee Beans, Starbuick, Old Town Coffee etc. Average per person per meal remains the same at RM 50 compares to one year ago. Some restaurant meal size becomes smaller but Dung just move from one restaurant to another, whichever is serving the meal the same way they did before the financial crisis. Eventually most of these restaurants will serve proper meal size and more promotions will surface out. Now TGIF also have kids eat free like Chillis. MAS matching Airasia low air fares allow Dung to travel all over the world more frequent now. Dung's bangalow architected by the same guy who designed for Dr. Mahatir continue to grow and takes up a huge chunk of his expenses but all these are rolled under his company accounts. Dung's inflation rate is 4%

Below table shows the summarized inflation rate for these 3 person :

So while all the supermarkets are advertising for how low their prices are, what is your Very Own Personal inflation rate NOW ?

or

or